According to a 2011 survey by the World Bank’s Internal Evaluation Group among Development Assistance Committee (DAC) donors, trust funds are often used to “influence the Bank” and to “target priority issues and countries.” Given the dissatisfaction of certain non-DAC donors, namely the BRICS, about their relatively low voting share on the Bank’s Board, one might think that trust funds would be an attractive instrument to exert greater influence or work together with other like-minded non-DAC donors. Such donors might use trust funds, particularly multi-donor trust funds, to assure their political neutrality vis-à-vis a certain recipient government (e.g., in Afghanistan through the Afghanistan Reconstruction Trust Fund ARTF), influence the World Bank by co-financing projects, or use the World Bank’s in-country presence, know-how, and capacity to increase the number of countries in which they are present as donors. Because the World Bank survey did not cover non-DAC donors about their preferences, I instead present evidence about their actual contribution patterns, such as the fact that non-DAC countries almost always cooperate with DAC countries in multi-donor trust funds, and suggest some hypotheses to explain this behavior.

New Data from the World Bank Gives Greater Insight into Non-DAC Donors Behavior

Using newly available data from the World Bank, we can now analyze in which countries and sectors donor countries see a comparative advantage in using a multilateral organization to implement development assistance and speculate about the rationale for that decision (e.g., expertise, political neutrality, accountability). The quality of the new World Bank data is excellent, in stark contrast to the often incomplete information about development assistance provided by non-DAC donors as described in the previous non-DAC series. Using data on multilateral aid is no alternative, as non-DAC donors have little influence over multilateral aid allocation (a fact often deplored by several non-DAC countries).

At the World Bank, trust funds are usually governed by those donors that have recently contributed to its thematic, country or regional focus. Decisions about allocation are made independent of the Bank’s Board of Governors, though projects funded by trust funds need to comply with the Bank’s social and environmental safeguard policies.

While it is interesting to study how non-DAC and DAC donors engage in trust funds, I do not interpret these findings as being generalizable to the bilateral aid allocation behavior of donors. In fact, trust funds might be used as a complementary instrument of bilateral foreign aid.

(Notes: I obtained the data directly from the World Bank trust fund office (CFGP). These data are also available online but without data on the fiscal year 2012. Note that the Bank’s fiscal year runs from July 1 to June 30. The choice of trust funds by DAC donors is studied by Reinsberg, Michaelowa and Knack (2014) and the recipient side by Eichenauer & Knack (2014).)

Non-DAC Preferences: Similarities and Differences

The following graphs and findings illustrate how donors engage (or not) in the so-called “new multilaterals” (also called global or vertical funds), such as the Global Environment Facility. Given that each trust fund is unique in its institutional design, the graphs only give an overview with a focus on non-DAC donors, which is not provided in the 2013 Trust Fund Report by the World Bank.

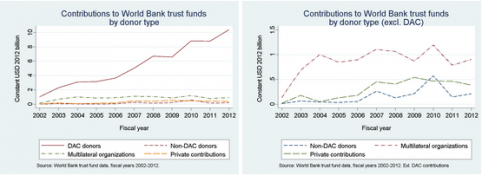

Figure 1 Figure 2

Contributions to multilateral trust funds have increased rapidly over the last decade for DAC donors, but not for non-DAC donors. Why are trust funds unattractive to non-DAC donors?

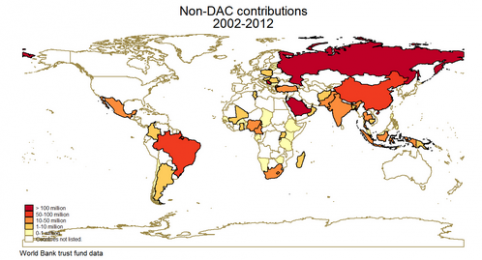

Figure 1 (above left) shows the steady rise in DAC contributions to trust funds over the fiscal years 2002-2012 and the overwhelming importance of DAC contributions. Abstracting from DAC flows, Figure 2 (above right) shows that aggregate non-DAC contributions to the Bank’s trust funds are lower than private contributions from foundations set up by companies and individuals except in 2010. There is no clear positive trend in non-DAC contributions. The world map, Figure 3 (below), gives an overview over the volumes contributed by individual non-DAC countries to trust funds. Russia and Saudi Arabia contributed the largest sums over the period examined, followed by further BRICS countries, namely Brazil and China.

Figure 3

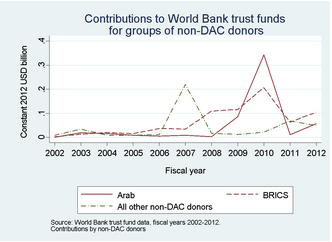

Given that non-DAC donors are a very heterogeneous group of countries, the next figures analyze three sub-groups: Arab League member states, BRICS and the remaining non-DAC donors. Figure 4 (below) shows that Arab donors have contributed to trust funds mainly in the fiscal years 2009 to 2011, with a spike in 2010. Contributions by the BRICS steadily increased until 2010, and decreased thereafter. It remains to be seen whether the creation of several new development banks will result in yet lower contributions in the years to come. Contributions from other non-DAC donors are relatively low, except for a 2007 spike due to a repayment by Serbia.

Figure 4

While aggregate non-DAC contributions represent less than 6% of all contributions even in 2010, the share of their contributions to a specific trust fund can be quite significant. For example, a fifth of total support for the Palestinian Reconstruction and Recovery trust fund originates from non-DAC donors. Arab donors contributed the bulk of these funds. It seems that non-DAC donors use trust funds when bilateral aid is unattractive because direct financial support would be understood as political support for the incumbent government in the recipient country.

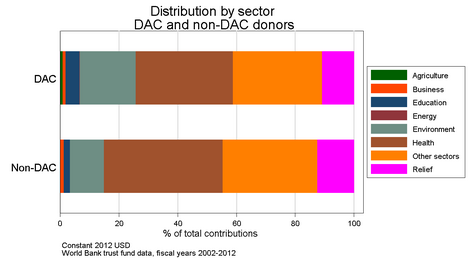

Figure 5

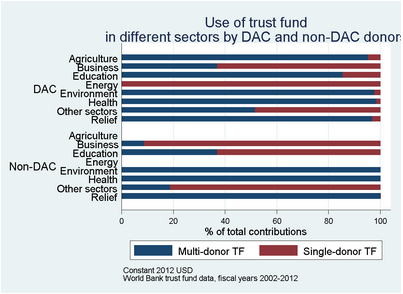

Figure 5 (above) compares the sector allocation of DAC and non-DAC donors. Overall, relative allocations are similar. The main difference is that DAC donors contribute a significantly larger share for environmental purposes, while non-DAC donors are relatively more active in the health sector. In absolute dollar amounts, however, DAC donors are the more important supporters of health trust funds.

Figure 6

Interestingly, trust funds do not only allow a donor country to engage with like-minded donors, but also to set up a single-donor trust fund. There are several factors influencing the choice for a single- or a multi-donor trust fund, where the latter requires finding agreement over allocation among the contributing donors. As Figure 6 (above) shows, DAC donors use single-donor trust funds in the energy sector, whereas non-DAC donors do not use trust funds at all in this sector, probably preferring bilateral cooperation in this relatively strategic sector. A majority of the financial support for market-related development activities, probably linked to economic self-interests of the donor country, is provided through single-donor trust funds. In contrast, support for global public goods such as environment, relief and health is provided through multi-donor initiatives. In education, agriculture, and other sectors, multi-donor and single-donor trust funds co-exist.

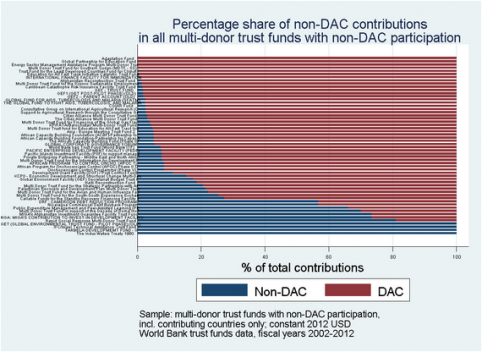

Figure 7 (below) illustrates the cooperation pattern of non-DAC donors. While the figure looks cramped at the first and second glance, the trust fund names need not be deciphered but are added for completeness only. For all multi-donor trust funds with at least one positive contribution by a non-DAC country, the final figure shows the relative share contributed by DAC and non-DAC donors respectively (not taking into account possible contributions by international organizations and private charity). Additionally, it demonstrates The figure shows that there is only one multi-donor trust fund - the Indus Water Treaty fund supported by Pakistan and India - in which non-DAC countries, as potentially “liked-minded” donors, cooperate only among themselves. In the fund “The Indus Water Treaty” fund, Pakistan and India are the only contributing parties. In this case, the World Bank seems to facilitate joint efforts against local challenges despite persisting political animosities. In each multi-donor trust fund, DAC and non-DAC countries cooperate. The non-DAC participation varying between an 80% stake and share varies between 80% and negligible shares.

Figure 7

Why is it that non-DAC donors seem to contribute to trust funds at a lower level than their DAC counterparts?

One explanation often proposed is that trust funds are unattractive because the projects need to comply with the Bank’s safeguards and standards. This may be considered as interfering with the recipient country's sovereignty, a contradiction to the principle of non-interference, a key characteristic of South-South cooperation. The Africa Growing Together Fund (AGTF), a trust fund set up as recently as May 2014 supported by China and managed by the African Development Bank, shows that safeguards are not the major and certainly not the only factor deterring non-DAC donors’ engagement in World Bank trust funds. Thus, the question remains open as to how trust funds can be made more attractive to non-DAC donor countries as the World Bank moves to increase use of umbrella facilities.